PRESERVE AT PRINCETON TOWNHOMES

2213 County Road 447, Princeton, TX 75407

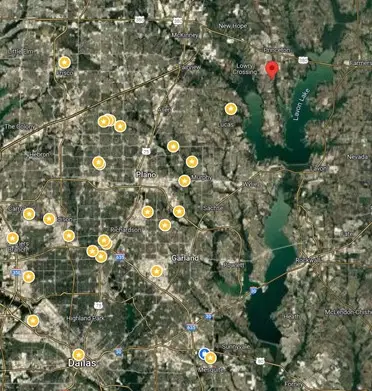

A Built to Rent Community in the fast developing suburb of Dallas

INVESTMENT OPPORTUNITY FOR ACCREDITED INVESTORS

- About Townhomes

WELCOME TO THE PRESERVE AT PRINCETON TOWNHOMES-BTR (Built to Rent)

Built to rent” refers to a real estate development model where properties, like houses or apartments, are specifically constructed and designed with the intention of being rented out to tenants instead of being sold to individual owners.

- Investment of $50,000 upon execution of the contract will entitle you to 1% ownership in the project.

- Minimum Expected Return 30% Annually

- 60% Over 24 Month Period = $80,000 Projected

- Summary

Executive Summary

Vision

Revolutionizing modern living with a premium Build-to-Rent community tailored for today’s renters.

Opportunity

Capitalize on the growing demand for rental housing in Dallas, Texas, fueled by population growth and affordability challenges in the homeownership market.

Project Highlights

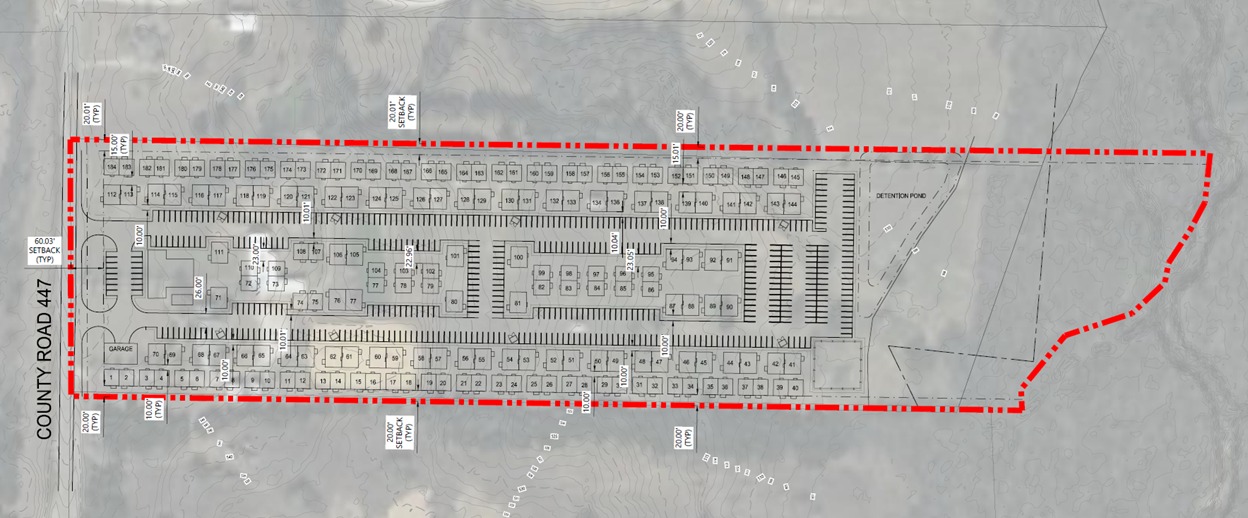

184 Units of units across 20 Acres.

Estimated project cost: $26.8M

Projected IRR: 38.7%.

Construction timeline: April 2025 to March 2027.

Development team has built 25+ multi family projects within DFW Metroplex. Solid track record

- Who We Are

YOU ARE INVESTING IN CONSTRUCTION OF 184 MODERN BTR TOWNHOMES

- 2 BR / 2 Bath

- 104 Units @

- 810 sq. ft./ unit

- 1,620 sq. ft. / duplex

- 3 BR/ 3 Bath

- 80 Units @

- 810 sq. ft./ unit

- 1,620 sq. ft. / duplex

- Opportunity

Market Opportunity

Dallas-Fort Worth as a Top Real Estate Market

The DFW metroplex has been named the nation’s top spot for real estate investment and development for 2025, according to a report from Price water house Coopers and the Urban Land Institute.

Wall Street Is Betting Billions on Rental Homes as Ownership Slips Out of Reach

https://www.wsj.com/real-estate/build-to-rent-single-family-home-investments-d6e57200

Build-to-Rent Leader: DFW Led the U.S. in Hot Construction Category in 2022″ reports that Dallas-Fort Worth led the nation in BTR home completions in 2022, indicating strong market activity.

The 5 housing markets to watch in 2025 — especially if you’re an investor. Dallas at number 1

https://nypost.com/2024/11/06/real-estate/the-5-housing-markets-to-watch-in-2025-especially-if-youre-an-investor

Lower Tenant Turnover

BTR properties often attract tenants looking for long-term rental options, leading to lower turnover rates compared to traditional multifamily units. For instance, Kinloch Partners, a developer of BTR communities, reports that their tenants stay for about five years on average, compared to approximately two years in typical apartment complexes.

- Find Us

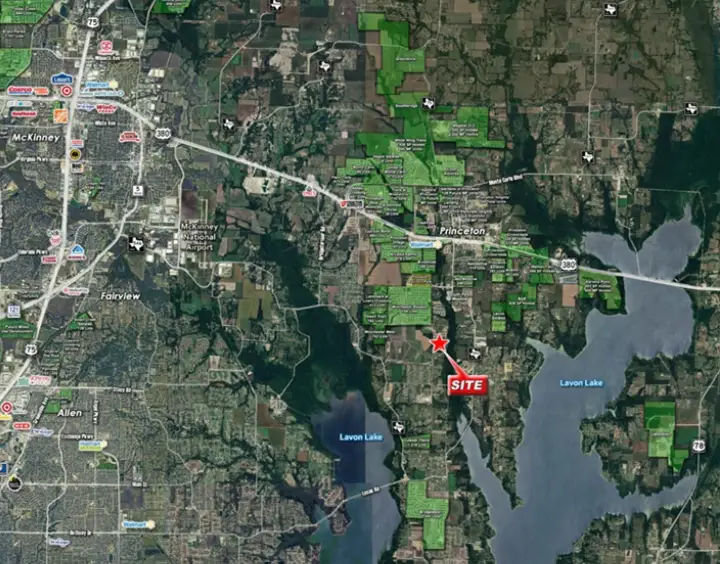

Our Location

Princeton’s population surged by 22.3% between July 2022 and July 2023, ranking it as the third-fastest-growing city in both Texas and the U.S.

Homes in Princeton sold after an average of 77 days on the market, indicating a steady demand.

Affordable Housing Options: Attracts families and professionals priced out of larger cities but seeking suburban amenities.

Educational Excellence: Princeton Independent School District (ISD) is highly rated, attracting families prioritizing good schools.

Recreational Opportunities: Princeton is close to Lake Lavon, providing residents with access to fishing, boating, and other outdoor activities.

- Find Us

Location Continued

- Plan

APPROVED CONCEPT PLAN WITH CITY

A $44M DOLLARS BTR (Built to Rent) COMMUNITY WITH 184 UNITS TO BE BUILT in Dallas Metroplex

Brick and Stone Exterior

Quartz Kitchen Top, Stainless Steel Appliances.

On-site property management

Modern Design with Engineered Wood Floors

Only 100 Shares are Available

- Terms

FINANCIAL TERMS

Investment of $50,000 upon execution of the contract will entitle you to 1% ownership in the project.

The land and total development will be registered in the company LLC name and you will be a SHAREHOLDER.

PROJECTIONS:

Projected return 30% per annum, over 24 month period =$ 80,000

They will be Preferred Common Stock1 shares with the condition that the first amount of profit will be given to investors to fulfil their financial commitment before being given to any regular.

Preferred Stock

The term “stock” refers to ownership or equity in a firm. There are two types of equity—common stock and preferred stock.

Preferred stockholders have a higher claim to dividends or asset distribution than common stockholders. The details of each preferred stock depend on the issue. In the event of a liquidation, preferred stockholders’ claim on assets is greater than common stockholders.

April 30 2025

Project Start Date

March 31 2026 & 2027

Payout

Financial Summary

| BEST CASE | EXPECTED CASE | WORST CASE | |

|---|---|---|---|

| Number of Lots | 184 | 184 | 184 |

| Total Sq footage | 175,440 | 175,440 | 175,440 |

| Land Area – Acres | 20.60 | 20.60 | 20.60 |

| Total Cost of Finished TH | $25,480,632 | $26,841,064 | $29,464,629 |

| Total Sale | $38,596,800 | $35,965,200 | $34,210,800 |

| Net Profit | $11,691,168 | $7,624,136 | $3,171,171 |

| Return of Investment | $3,000,000 | $3,000,000 | $3,000,000 |

| Profit avail after Return of Capital | $8,691,168 | $4,624,136 | $171,171 |

| Profit per Share (100 shares) | $86,912 | $46,241 | $1,712 |

| Internal Rate of Return (IRR) | 65.48% | 38.74% | 0.28% |

PROJECTIONS

| BEST CASE | EXPECTED CASE | WORST CASE | |

|---|---|---|---|

| Number of Lots | 184 | 184 | 184 |

| 2 Bedroom units 104 units *810 | 84,240 | 84,240 | 84,240 |

| 3 bedrooms units 80 units * 1140 | 91,200 | 91,200 | 91,200 |

| Total sq footage | 175,440 | 175,440 | 175,440 |

| Land Area – Acres | 20.60 | 20.60 | 20.60 |

| Land Area | 865,200 | 865,200 | 865,200 |

| Cost of Land | $3,200,000 | $3,200,000 | $3,200,000 |

| Cost per sq foot | 3.70 | 3.70 | 3.70 |

| Total Horizontal Cost | $3,498,817 | $3,887,575 | $4,081,954 |

| Vertical Cost / sq foot | $96 | $101 | $113 |

| Total Vertical | $16,783,468 | $17,666,808 | $19,875,159 |

| Financing Exp | $1,998,347 | $2,086,681 | $2,307,516 |

| Total Cost of Finished TH | $25,480,632 | $26,841,064 | $29,464,629 |

| BEST CASE | EXPECTED CASE | WORST CASE | |

|---|---|---|---|

| Cost per Sq Foot | $145 | $153 | $168 |

| Sale Price / Sq Foot (minus fees) | $220 | $205 | $195 |

| Total Sale | $38,596,800 | $35,965,200 | $34,210,800 |

| Gross Profit | $13,116,168 | $9,124,136 | $4,746,171 |

| General Admin / Marketing Exp | $1,425,000 | $1,500,000 | $1,575,000 |

| Net Profit | $11,691,168 | $7,624,136 | $3,171,171 |

| Investment Amount | $3,000,000 | $3,000,000 | $3,000,000 |

| Profit Available After Return of Capital | $8,691,168 | $4,624,136 | $171,171 |

| Each 1% Shareholder (24 months) | $86,912 | $46,241 | $1,712 |

| 2% Share is $100,000 | $100,000 | $100,000 | $100,000 |

| Returned to 1% Shareholder | $273,823 | $192,483 | $103,423 |

| Internal Rate of Return (IRR) | 65.48% | 38.74% | 0.28% |

- Investment

SOLID INVESTMENT

High Demand and Stable Revenue

Build-to-Rent (BTR) communities cater to the growing demand for rental housing, driven by affordability challenges in homeownership and changing lifestyle preferences. These communities attract families, young professionals, and retirees seeking high-quality, maintenance-free living, ensuring a steady tenant base and stable cash flow for investors.

Modern, Amenity-Rich Living

BTR developments offer newly built, energy-efficient homes with modern designs, private yards, and community-focused amenities like pools, fitness centers, and dog parks. This combination enhances tenant satisfaction and retention rates, reducing turnover costs and boosting long-term profitability.

Resilience and Growth Potential

BTR properties are less vulnerable to economic fluctuations, providing a reliable investment even during downturns. With scalable operations, centralized management, and a focus on suburban areas near urban centers, these communities represent a lucrative, future-ready real estate segment with significant growth potential.

- Easy Steps

THE PLAN

April 2025

Land Acquisition

December 2025

Land Development (All Utilities)

August 2026

First Building Ready for Occupancy

- Facts

QUICK FACTS

- + 1 469 333 1529

- www.PreserveATPrinceton.com

- info@PreserveATPrinceton.com

Development Team

The Development team is headed by a company that has built 25+ communities in the DFW area.

Finance & CPA

An independent CPA firm will be hired to maintain all books and available for inspection.